The in situ grade, total tonnage and vanadium containment puts the specially structured Bushveld Vanadium project platform in a strong position against all-comers at a time of stepped up tempo in the vanadium sector, which saw TSX-listed Largo Resources achieve first production at the new Maracas vanadium project in Brazil this week, and ASX-listed Yellow Rock Resources step on the vanadium pedal with a $3.36-million capital raise to fund work on its flagship Gabanintha project in Western Australia.

South Africa-based Bushveld Vanadium has a sky-high grade, which sets it apart as the vanadium bulls begin to charge and it intends entering the fray with a $262-million capital outlay that takes it all the way to vanadium pentoxide (V2O5), with a shallow opencast mine feeding a salt-roast processing plant that will produce at a rate of 10 000 t of V2O5 a year.

Bushveld Vanadium’s scoping study indicates an operating cost of $2.72/lb of V2O5 flakes compared with a current price of $5.60/lb and a projected price of $7.50/lb when the company produces its first vanadium in 2019.

“There’s a great buzz around vanadium and the message of its importance as a commodity is being rapidly spread,” Bushveld Minerals CEO Fortune Mojapelo told Mining Weekly Online in a video interview (see attached).

“We’re very uniquely situated with an extremely high in situ vanadium grade. That’s definitely our competitive advantage in that we will be able to come to market with a high-grade product that is easily and relatively cheaply extractable using existing technologies,” Bushveld Minerals executive director Anthony Viljoen commented to Mining Weekly Online. (Also see attached video)

South Africa’s bountiful Bushveld Complex already accounts for 26% of the world’s vanadium reserves and 26% of the world’s vanadium production, which arises mainly from four operations on its western and eastern limbs.

But Bushveld Vanadium has turned to the more abundant northern limb, where the orebodies are 8 m thick compared with 2 m elsewhere, which facilitates mechanised mining in the chunky packages of the main magnetite layer (MML).

Moreover, the company will not merely mine and ship but will also process the vanadium ore in South Africa.

“We’ll keep the value uplift local. The benefits for the country are that much bigger and this is one case where the benefits for the shareholders and the benefits for the country are totally in sync,” Mojapelo commented to Mining Weekly Online.

The integrated mining and processing project fits squarely into the South African government’s push for beneficiation, with all its incentive benefits.

Funding will be by a combination of local debt and London equity following the setting up eight months ago of the special Bushveld Vanadium platform.

“We will look for an equity solution specifically within Bushveld Vanadium, but then also to the debt capital markets," said Viljoen.

The $262-million capital expenditure (capex) for an integrated project is seen as a modest capital requirement.

Time-wise, the intention is to complete the project’s prefeasibility studies within the next two years in time for development over a two-year period so that production can begin in 2019.

No reinventing of the wheel is required and the project is emerging at a time when vanadium demand is growing.

It will require about 15 MW of power.

“We’re very excited about our vanadium project. It’s based on our MML resource, which is next to our iron-ore and titanium resource on the northern limb.

“We’re kicking off with 52-million tons, which has potential to grow significantly,” Mojapelo told Mining Weekly Online.

Bushveld’s study scopes the 10 350 t of vanadium pentoxide flakes a year on the back of a one-million-ton-a-year run-of-mine, which will give the company an 8% to 9% share of the world market.

The simple opencast mining operation, extending over a 5.5 km strike, will go down to a depth of 80 m.

“Given that the salt-roast process is so well proven, taking the project to production is what we want to do quickly, because the vanadium market is currently very buoyant and we want to take advantage of that,” Viljoen said.

The main driver of vanadium demand is its use to increase the tensile strength of steel while reducing its weight, which represents about 90% of the market.

What is poised to drive even greater demand growth are moves in China where the government has passed policy directives to phase out low-strength rebar, which does not have a vanadium content, and replace it with high-strength rebar, which contains vanadium.

On top of that, vanadium redox flow batteries are well positioned in the bulk power storage field, where electricity utilities can use them to store significant amounts of power for long periods.

These long-lasting batteries can connect to the power grids without destabilising them, allowing power to be stored in periods of low demand, and released during periods of high demand.

The benefit of this is deferred capex on power generation through peak shaving.

While vanadium batteries are not the only energy-storage solution, they have robust industrial use plus the upside of a metal that is in its infancy in energy storage.

“We see the vanadium market expanding quite rapidly in the coming years as technology develops,” Viljoen told Mining Weekly Online.

The concentrate will have 2% V2O5 vanadium content, which is world class as concentrates go.

“It’s a fantastic resource. In-situ-wise we are talking 1.48% already. When you’ve got a simple process flow sheet like we are talking about, which is established in South Africa with decades of experience and skills to implement it, it makes a lot of sense to process all the way,” Mojapelo commented to Mining Weekly Online.

The scoping study indicates operating margins of more than 50%, a pre-tax net present value (NPV) of $561.9-million and a post-tax NPV of $263.6-million.

In kilogram terms, operating costs of $5.99/kg are expected and the life-of-mine is 30 years, with payback to start four years and four months from the start of mining.

The concentrate will have a 55% iron content.

Its scoping study is based on the outcrop of the MML where drilling and assayed data show 1.5% and 1.7% V2O5 in magnetite across the 60-metre mineralised zone.

The company is developing a mineral resource estimate, which is likely to add to the current 52-million-ton project.

Analysis shows that the project is in the low-cost high-volume category of global vanadium projects.

Meanwhile, at Largo’s Maracas project in Brazil, production volumes are expected to increase to the project’s nameplate capacity of 9 600 t.

With an offtake in place with commodities trading company Glencore, Largo expects to benefit from vanadium demand, which has grown at a rate of more than 6% for the past several years.

Vanadium’s requirement in steel, the stationary energy market and in the electric vehicle industry appears destined to grow over time.

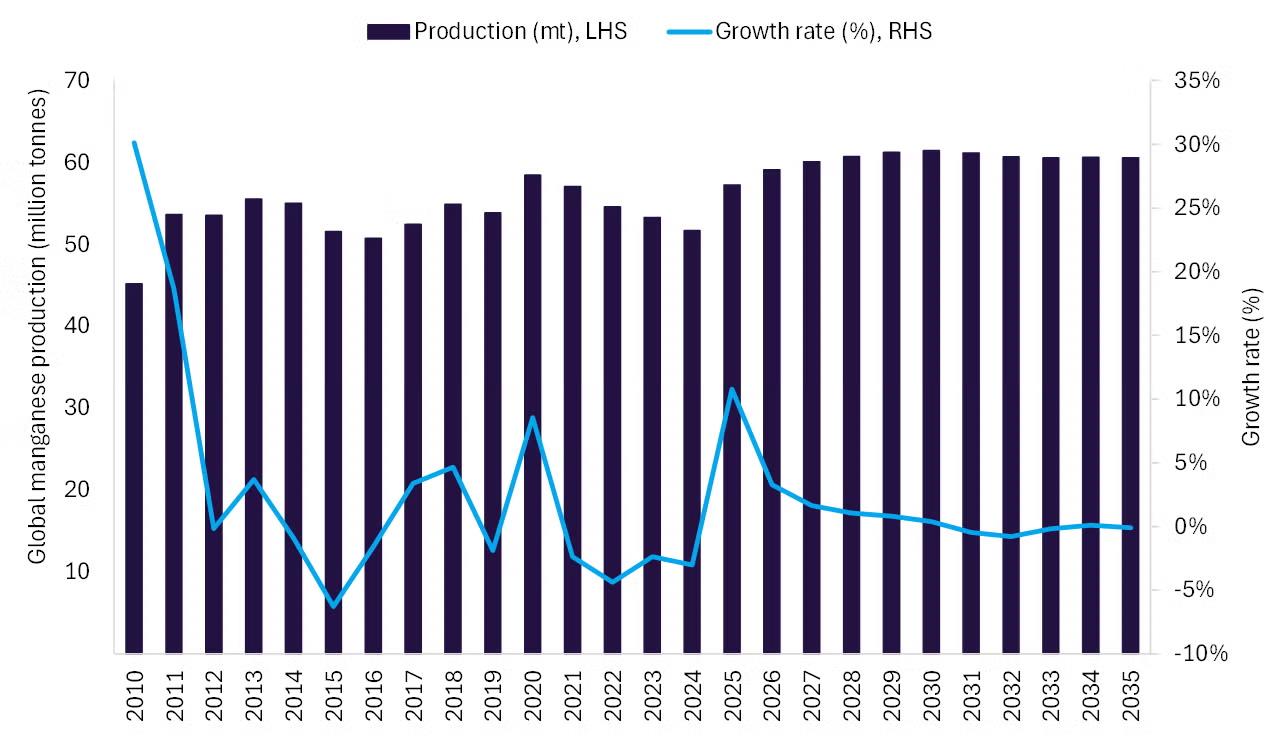

In 2010, more than 95% of the 56 000 t of vanadium produced was mined in South Africa, China and Russia.

Among the companies looking to expand that geographical supply base is American Vanadium, the TSX venture-exchange company that has the Gibellini vanadium project in Nevada, US, with capacity to supply 25% of America’s needs and add to the world’s current supply of the soft silver-grey ductile transition metal that is the twenty-third element on the periodic table.

Vanadium flow batteries are tanks of vanadium in dilute sulphuric acid, which allow continuous storing and discharging of energy on to electricity grids, helping countries to deliver on clean energy and carbon reduction targets.

While virtually all other forms of battery have two competing metals, the vanadium flow battery is more like a capacitor, with the vanadium occurring in multiple states in sulphuric acid solution and separated by a membrane.

The Chinese and Japanese have vanadium batteries that have achieved 10 000 charges and discharges.

Vanadium flow batteries in large fields have the ability to take an unprofitable wind farm and turn it into a commercially viable operation, because the power produced when the wind blows at night can be held, and when it is required, it can be dispatched immediately on to the grid economically.

US multinational, Cellstrom, which is owned by Gildemeister, of Germany, is commercialising these batteries.

The US government has listed vanadium as an element to watch and recognises that it needs to take a serious look at obtaining a secure supply of vanadium.

The US Department of Energy describes the country’s electricity grid as the world’s largest supply chain without “a warehouse”, a place of mass storage.

In the electric vehicle market, lithium-vanadium batteries are said to produce greater power and range and Subaru has reportedly chosen a lithium-vanadium battery for its prototype G4e electric vehicle to more than double the range on electric power alone.

Lithium-vanadium batteries can reportedly also be recharged faster.

Vanadium flow batteries are distinguished from fuel cells by their chemical reaction being reversible – they can be recharged without replacing the active chemicals.

Because the same metal is on both the positive side and the negative side, they require a lot of vanadium.

High capacity is attainable by using larger and larger storage tanks, which can be left completely charged or discharged for long periods.

- [Editor:Mango]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think