This week, the ferrosilicon market was weak, the futures fell continuously and by a large margin, the spot quotation followed the decline, and the transaction performance was insufficient. It was reported that the tender price of a steel plant in Hunan, cash including tax, has dropped to 8980 yuan per ton; Due to the rise of raw coal price, the overhaul and production reduction of semi-coke enterprises at the raw material end increased, and the supply decreased. Some enterprises in Shenmu region adjusted the price of small-sized semi-coke to 1950 yuan per ton; At present, the profit of the manufacturers was OK, and the utilization of capacity was stable temporarily, but the downstream demand has not yet recovered significantly. The confidence in the market was slightly poor, and the market operation was more cautious.

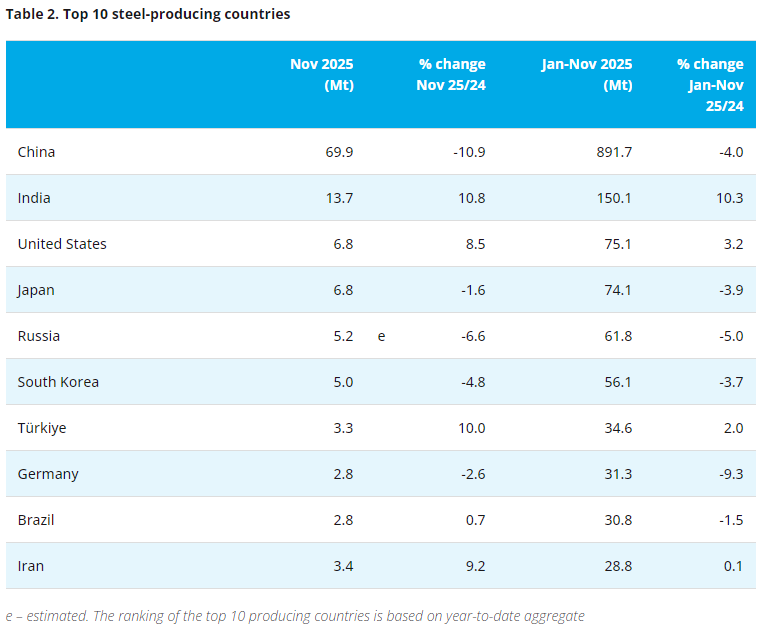

Downstream, according to the data of the National Bureau of Statistics: in May 2022, the average daily output of crude steel in China was 3.1165 million tons, an increase of 0.8% month on month, a new high in the year; In May, China's crude steel output was 96.61 million tons, a year-on-year decrease of 3.5%; From January to May, China's crude steel output was 435.02 million tons, a year-on-year decrease of 8.7%. According to the data of China Iron & Steel Association, in early-June, the key iron and steel enterprises produced 22.8865 million tons of crude steel, with a daily output of 2.2886 million tons, a month on month decrease of 1.32%; At the end of early-June, the steel inventory was 18.5475 million tons, an increase of 605100 tons or 3.37% over the previous ten days. A decrease of 201000 tons or 1.07% over the same period last month; An increase of 7.2506 million tons over the beginning of the year, an increase of 64.18%; An increase of 4.3177 million tons or 30.34% over the same period last year. It was 663600 tons more than the highest point of last year (17.8839 million tons in early-March), an increase of 3.71%. This week, the domestic steel market was weak, with obvious off-season characteristics and weak supply and demand; Considering the cost of iron ore and coal (some steel mills estimated that the cost of coal has exceeded that of iron ore) and profit, the arrival of high temperature and rainy weather, some steel mills may arrange maintenance and production cut. It was expected that the decline of steel price may slow down in the later period.

This week, the domestic magnesium market has been operating at a low level due to the continuous short demand, and was still oversupplied; This week, the price of ferrosilicon fell, the cost of raw coal became the main supporting factor for the magnesium plants, and there were difficulties in price concessions. However, the downstream demand, including overseas demand, was weak, and the operation pressure of magnesium market remained. On Friday, 17th, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 25500-26000 yuan per ton. Pay attention to the demand follow-up.

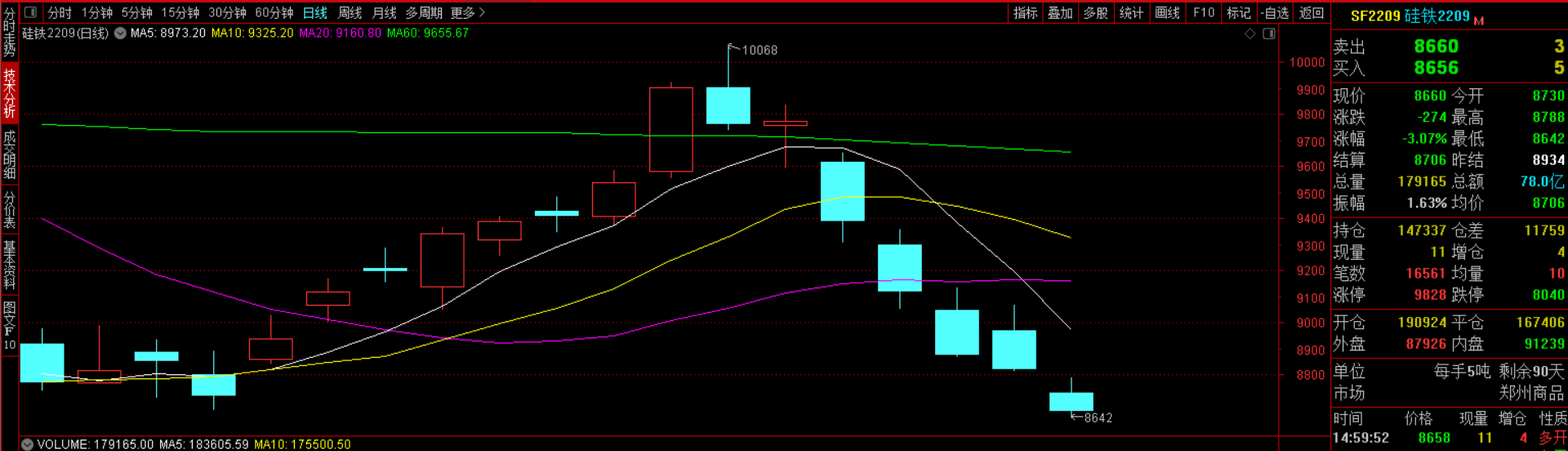

The weekly opening price of 2209 main contract was 9,618, the highest price was 9,652, the lowest price was 8,642, the closing price was 8,660, the settlement price was 8,706, the trading volume was 918,028, and the position was 147,337, down 10.89%.

Below are ferrosilicon futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

6.13 |

9618 |

9652 |

9308 |

9388 |

9432 |

203570 |

138374 |

-3.40% |

|

6.14 |

9300 |

9360 |

9054 |

9120 |

9172 |

193759 |

138046 |

-3.31% |

|

6.15 |

9050 |

9134 |

8868 |

8876 |

9022 |

180202 |

143123 |

-3.23% |

|

6.16 |

8970 |

9068 |

8812 |

8822 |

8934 |

161332 |

135578 |

-2.22% |

|

6.17 |

8730 |

8788 |

8642 |

8660 |

8706 |

179165 |

147337 |

-3.07% |

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think