[Ferro-Alloys.com] South Africa joins the critical minerals show

South Africa released its Critical Minerals and Metals Strategy for public comment on 20 May 2025. It is a polished and insightful document, reflecting the input of the country’s national minerals and technology research organisation, Mintek, and clearly identifies the jurisdiction’s key resources. But despite the document being described as a ‘Strategy’ it reads more like a rather good Green Paper (a discussion document) than a clear indication of the road ahead. In fact, it’s policy implications suggest some uncertainties for the mining industry.

The paper contains the first-ever list of what South Africa regards as its critical minerals. It clearly specifies the criteria used: Export significance; local economic significance (including job creation and beneficiation); industrial importance (especially to high-tech sectors); development alignment; and global market demand.

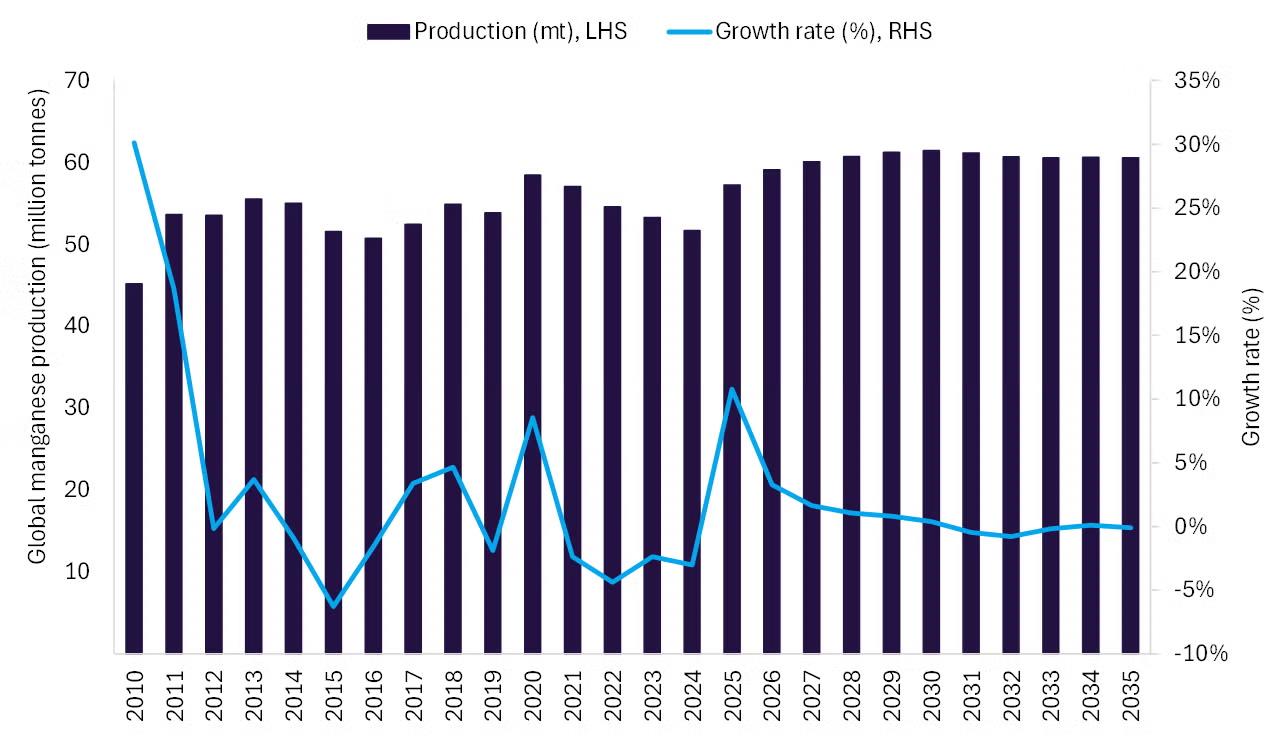

The critical minerals list identifies five ‘Highly Critical Minerals’: Platinum, manganese, iron ore, coal and chrome ore. This is followed by a list of five ‘Minerals with Moderate to High Criticality’: Gold, vanadium, palladium, rhodium and Rare Earth Elements and another eleven minerals listed as of ‘Moderate Criticality’ (copper, cobalt, lithium, graphite, nickel, titanium, phosphate, fluorspar, zirconium, uranium and aluminium). The strategy promises to constantly review the list and update it when necessary.

Some reflection on the ‘Highly Critical Minerals’ category is revealing. These, together with gold (listed in the lesser, ‘Moderate’ category) are South Africa’s major minerals exports and in three cases (platinum, manganese and chrome ore) the country is the world’s leading exporter. Coal will prove to be controversial in some quarters. It is specifically excluded from some critical minerals lists, including that of the US. But coal is critical for both energy generation in South Africa and as an export commodity, where it currently ranks second, behind gold, in value.

There is no universally accepted definition of critical minerals. In fact, the major mineral markets, the US, China and the EU all have different critical minerals lists with only a limited degree of overlap. Only 10 minerals that make the lists of all three major markets: Aluminium, antimony, cobalt, copper, fluorspar, graphite, lithium, nickel, tungsten and rare earths. Nine of these appear on the South African list (excluding antimony).

Critical mineral lists are a policy instrument and South Africa is no exception. The implications of the list are spelled out in some detail in the Strategy. It lists six ‘Pillars’ for future actions. These point towards an overarching ambition to add value to minerals mined in the country as well as regional manufacturing ambitions. The lower part of the list – it’s ‘Moderate Criticality’ section – includes industrial minerals that are not mined in South Africa but which can be considered important to what the strategy appropriately calls the country’s ‘re-industrialisation agenda’. These include lithium-ion battery inputs cobalt, lithium and graphite as well as aluminium. The Strategy lists its industrial ambitions including microelectronics, clean energy production and storage, digitisation, e-mobility, medical devices and advanced manufacturing.

Beneficiation and downstream value add (industrial development) have been on the agenda for many years. But South Africa has de-industrialised in recent decades. The industrial sector’s contribution to GDP has fallen from 28 percent in 1993 to 18 percent in 2024. The Critical Minerals and Metals Strategy is based on a clear ambition to reverse this trend.

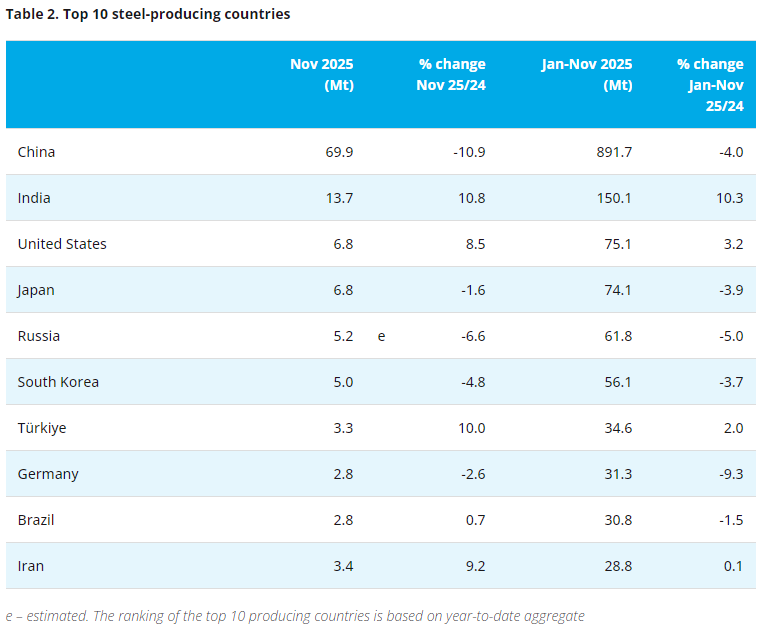

However, interventions to reverse deindustrialisation in South Africa have often produced unanticipated consequences or simply proven misguided. The complexity and contradictory nature of state interventions in the steel sector was explained in a recent tralac blog. This failure, which has seen steel production halve in two decades, raises concerns about the effectiveness of state intervention more generally.

It is thus of concern to see a long list of intervention options listed in the Strategy. Each of the six pillars listed in the document has a series of strategic interventions attached, 64 in total. Some of these are innocuous (‘introduce critical minerals workforce planning’ and ‘establish accredited educational and training programmes’) and others are widely accepted good practise (‘address regulatory bottlenecks’ and ‘explore the adoption of a flow-through shares scheme’).

Other interventions seem ambitious, in some cases perhaps too much so. These include manufacturing ambitions in the lithium-ion battery (LiB) and hydrogen fuel cell spaces as well as local electric vehicles. These are not necessarily entirely misplaced but there is not a strong sense of what is required of government, which department should lead and how the private sector can get involved.

The intervention suggesting a regional framework (p. 36) is a reference to the mining of LiB inputs in the Democratic Republic of Congo (cobalt), Zimbabwe (lithium) and graphite (Mozambique). The countries mine these critical minerals in sufficient quantities to supply a viable manufacturing industry although almost all current output in exported either to China or the United States. The Strategy, as it currently stands, needs to be complimented by a feasibility study of how to bring these minerals together in viable quantities.

It should be pointed out that the Strategic Interventions are not prioritised nor attached to actions or actors. Critics might argue that they thus read like a list of ingredients without a sense of how to combine them in a strategy.

Running through the Strategy is an awareness of the limitations imposed by rising energy costs. But government cannot change the steep upward trend of Eskom’s price increases by decree, an issue which may render beneficiation ambitions moot. Only two percent of South African manganese is locally processed, and chrome appears to be heading in the same direction with half the country’s 59 chrome furnaces having closed in recent years.

Some of the Strategic Interventions raise potential red flags. The Strategy proposes to designate local chrome content for stainless steel products purchased by government. But the designated local content lever has a history of ineffectiveness in South Africa, often floundering on peripherally related issues including currency, energy costs and public procurement inefficiencies.

The Strategy also proposes to ‘explore the use of financial instruments’ to restrict chrome exports to beneficiated product. This is a reference to export bans or tariffs. The Strategy refers to the bans on raw material exports in Zimbabwe (lithium) and Indonesia (nickel) and appears to suggest such a mechanism would be desirable in South Africa. It may be, although mining companies may have problems with it. But the Strategy’s use of the idea of ‘exploring’ the mechanism may (and should) imply a consultative process.

South Africa’s Critical Mineral and Metals Strategy is a well-informed and coherent document which will provide a useful basis for policy development. It does however lean towards intervention and it is to be hoped that government treats these 64 points as a basis for further negotiation with industry stakeholders rather than accepted policy positions ready for implementation.

- [Editor:tianyawei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think